In this post, I will walk you through my process for putting a growth strategy in place.

To make it feel as close as real, I picked a fairly new and small company operating in a hyper-competitive niche: Email tracking software.

Note: Usually, in such a process, I’d be working with the core metrics of the client (revenue, retention, CAC, etc.), which makes the whole process a lot more data-driven.

Let’s get into it!

The Setup

I’ve been approached by Salesforge to put together a growth strategy for the company.

Please note the case is purely fictional – Salesforge is not a client of mine, I have no knowledge of their internal operations, and I’ve picked this specific company because it’s a new entrant in a highly competitive market.

Salesforge was founded in mid-2023 with the aim of fixing the problem of filling pipeline for sales teams through the use of programmatic cold email outreach.

Salesforge is a late entrant to an already busy category. Defined by G2 as Email Tracking Software (which itself is a subcategory of Sales Acceleration Software), the category lists 150+ providers, including heavy hitters like Salesforce and Hubspot.

Direct and indirect competitors

An interesting feature the landscape is that companies like Salesforge face competition from three ends of the spectrum:

Direct competitors like Apollo, lemlist, Instantly, and more

Upstream providers (typically CRM tools) like the (aforementioned) Salesforce, Pipedrive, Salesloft, etc.

Indirect competition from tools that don’t provide the email sending and tracking capabilities, but specialize in a specific part of the value chain – for example Cognism, which focuses on providing accurate and reliable data.

When looked through the lens of jobs-to-be-done or competing alternatives, this means a new entrant like Salesforge faces a lot more competition than a quick glance over the direct competitors would suggest.

How to win in noisy saturated markets

There are two essential features of a strategy that allows new entrants to compete successfully in a market with many competitors:

Disciplined positioning: This starts with developing a very clear idea of who you are for and how you are better than anyone else for that particular customer/segment. To get there, you need to start with an exercise of defining your positioning.

Unique take on the market: To cut it through the noise, you need to hold an opinionated view on how the problem should be solved and it works best if that view is rooted in the unique capabilities of your product.

Here is an example of a company that exemplifies this approach:

JustReachOut is an email platform that specializes in PR outreach. Everything from the messaging on the homepage to the specific features (e.g. database of 700k+ journalists, etc.) speaks to that segment.

If you check out their content, you’ll see that they have a unique approach on how outreach to journalists should be done – and unsurprisingly it is based heavily on the features that the software offers.

Now let’s compare with the current state of the Salesforge message:

Cold email that forges pipeline is perhaps the shortest way to define what outreach is – and that’s the opposite of what a unique (i.e. differentiated) take is.

In addition, there’s nothing on the website that lets you understand who this is for – no landing pages targeting specific personas and no use cases with clients who achieved big things with the product.

This is not a surprise, provided the company hasn’t been around for long, but it’s something that needs to change quickly.

So this is where we start.

Positioning & Messaging

In this part of the strategy, we need to answer two questions:

Who is Salesforge for? We need to define a clear ICP both in terms of the vertical/niche where they operate, but also the specific people within the companies that participate in the decision.

How do we go after the ICP? Then we need to create the assets to allow us to target those people – in the beginning that would be landing pages that target specific use cases, personas, and verticals.

Here are a few good examples of companies in the industry doing this well.

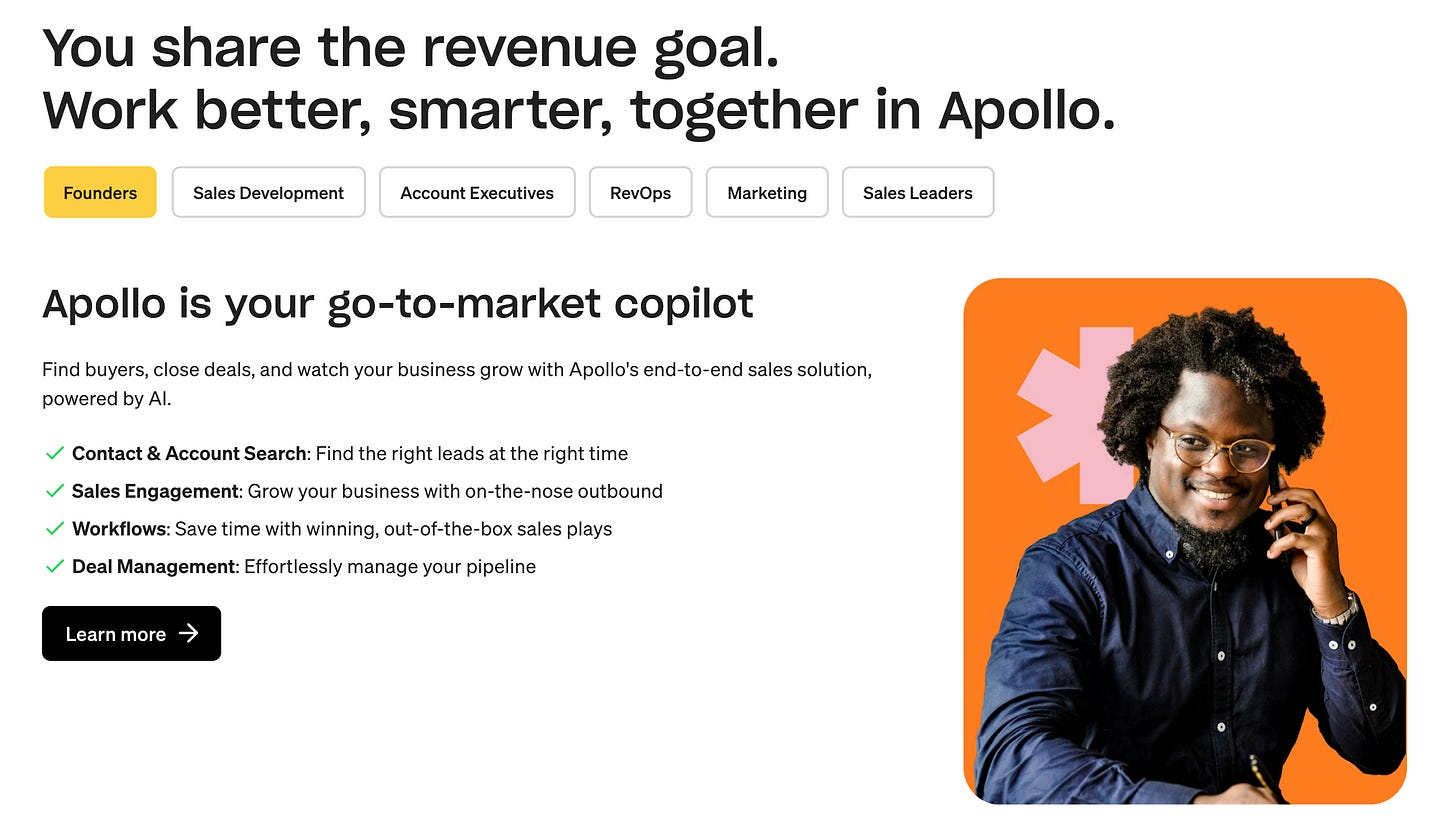

Apollo has a very good take on the roles/functions within their target companies:

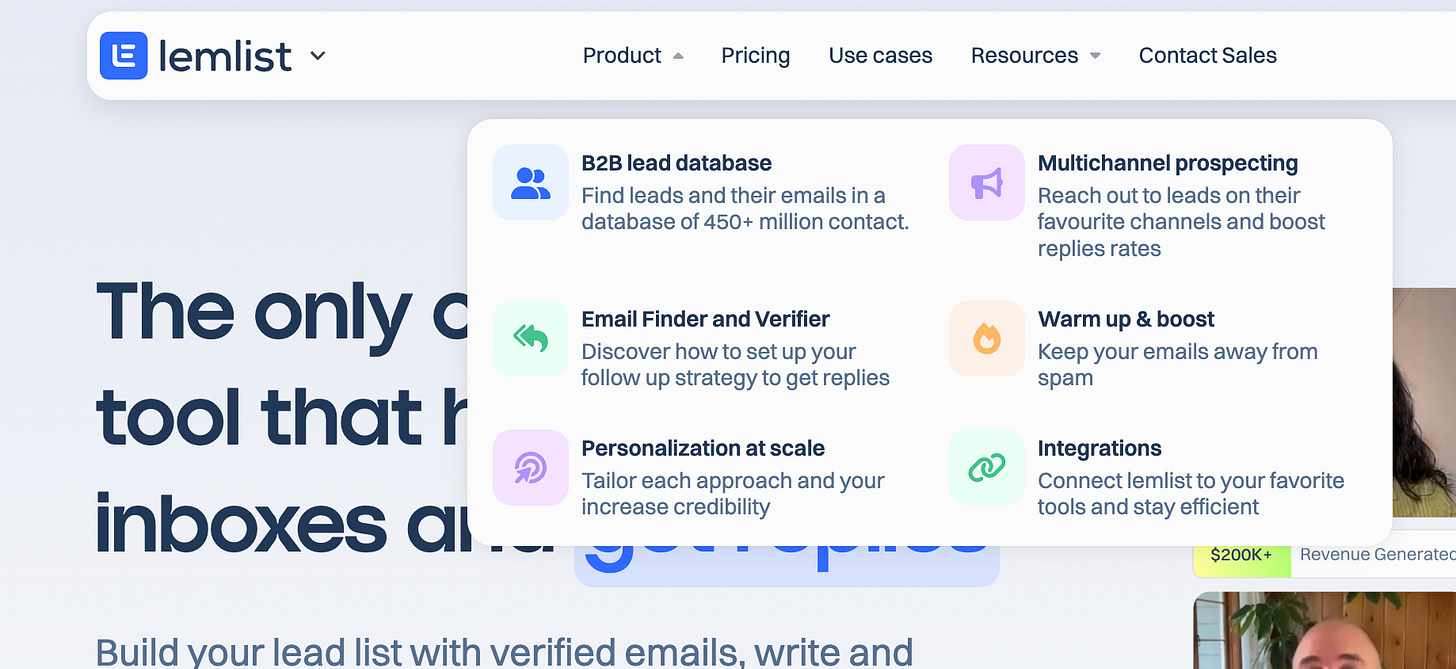

And I really like how for lemlist the product “features” are a list of jobs-to-be-done:

On top of this, these pages are positioned in a way that has them go after valuable keywords that lemlist wants to rank for:

But even big sites can’t expect to just rank for these keywords on their own – by publishing a landing page to go after the term.

That’s where a content marketing strategy comes in play.

Content Marketing

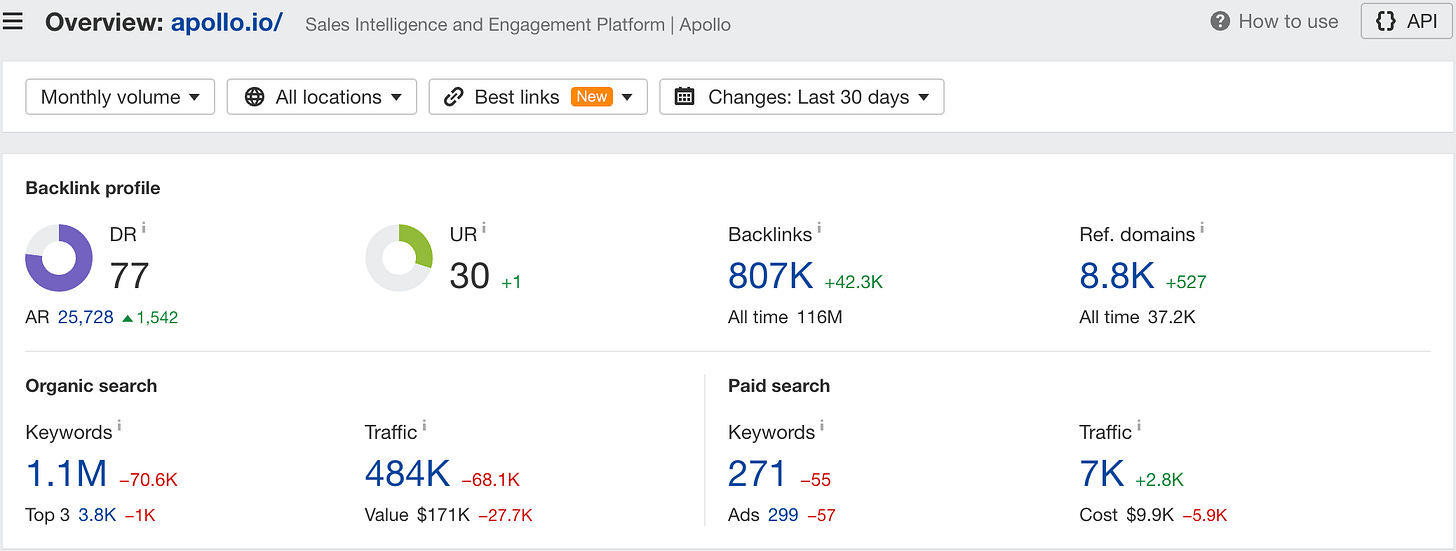

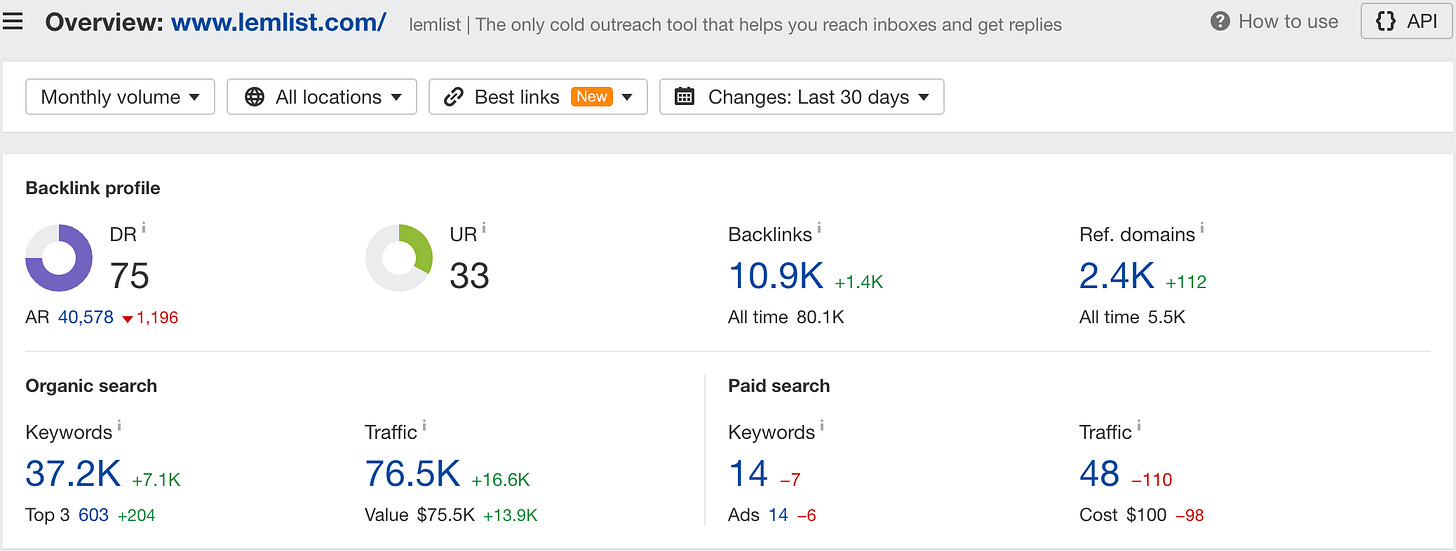

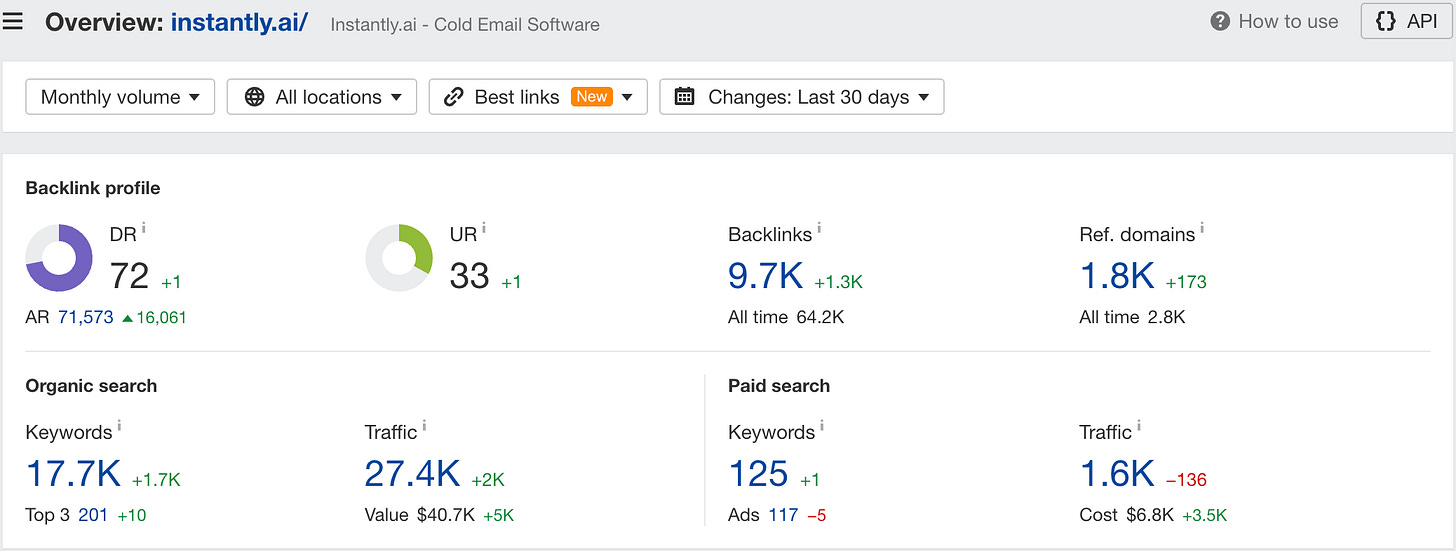

Content is still the king of B2B SaaS marketing – that’s why everybody is doing it:

(Notice the difference in numbers between organic and paid search. Also, Apollo ranking for over 1 million organic keywords is mind boggling.)

Good luck trying to beat them with brute force.

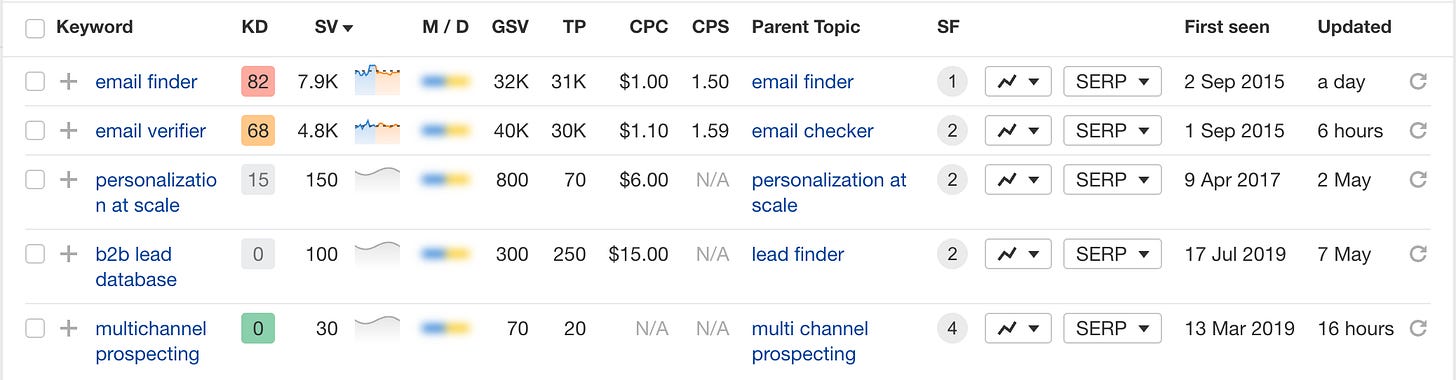

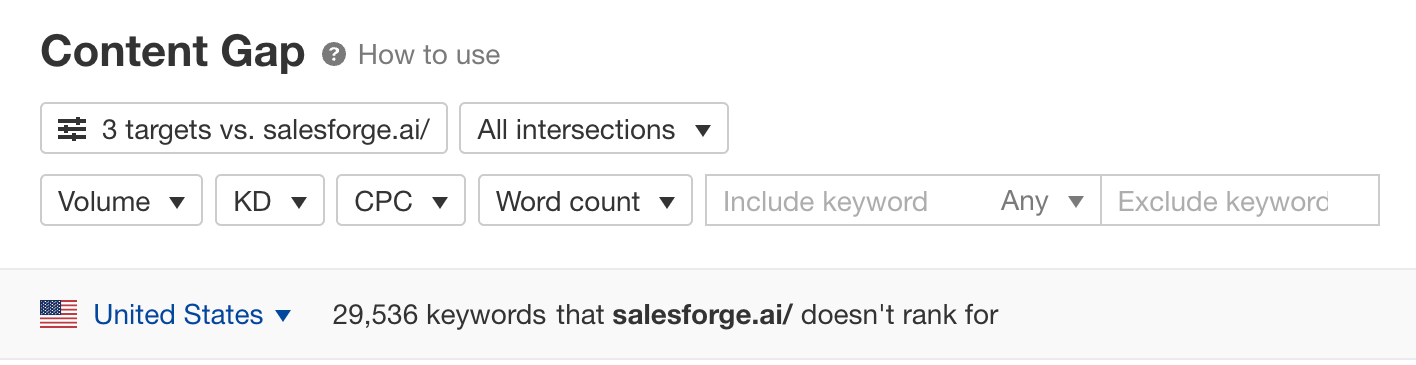

If you are a smaller/late entrant to a field that’s already saturated, what I’d do is to focus on the content gap that exists between me and my competitors.

It’s fairly easy to pull off in Ahrefs:

Work with the data to identify the opportunities that make the most sense in terms of relevance/topic and how easy it would be to conquer them.

Then, I would split the content I plan to produce in 3 broad categories:

Editorial content: Blog posts, video, white papers, etc. that help build awareness and educate your audience on how to solve their problems using your tool. For this type of content, I’d focus on creating amazing opinionated content that would help me stand out.

Competitor content: This would target terms like “best tools for outreach” and “Apollo competitors”. To understand what type of content to produce around those, I’d start with researching the search intent of Google users around those terms. This type of content is incredibly useful in the consideration phase when potential customers are problem-aware, but they don’t quite understand the landscape of all the ways in which their problem(s) can be solved.

Product content: This touches on the landing pages we discussed in the previous section when we spoke about positioning and messaging. You should produce content that explains your product offering by use case, industry, and persona that can help your audience in the decision stage when they’re picking what solution to go with.

For both the competitor and the product content, I’d be curious to look into programmatic production & optimization as a way to scale my content efforts effectively.

As with every marketing tactic, there’s a spammy and a productive way to do it.

Zapier is famous for the use of this tactic with their BOFU content:

According to Ahrefs, Zapier has created close to 63,000 of these templated pages (all follow a similar URL architecture that includes “/apps/”), resulting in more than 280,000 organic views each month.

To learn more about programmatic SEO/content, I recommend this guide by Ryan Law.

Performance Marketing

The content marketing strategy will take a while to kick in and start producing results.

In the meantime, we’ll build another growth engine around performance campaigns to make sure we have enough leads to close in the short term, while continuing to harvest the active demand in the longer term.

I would think about paid efforts in two broad directions:

Google Ads: The effort here will be concentrated on bidding on keywords with high commercial intent. An ideal way to think about this is that we should appear with our product pages for these KWs.

Social Ads (Facebook/Instagram/LinkedIn): For this part of the strategy, I’d focus completely on retargeting to people who visited the website, but did not complete any action.

This is a fairly standard playbook, which gives you the 80% of what you can achieve with performance campaigns.

Brand & Social Selling

LinkedIn is quickly becoming a dumpster fire (don’t act surprised), but it’s the best place to help you connect with a business audience at the moment.

Which means there’s an opportunity for differentiated marketing on it.

The way I’d tackle that is by appointing several people from the Salesforge team to serve as brand ambassadors. This works best when it comes from the founders – because we know they’re in for the long haul and, therefore, we can establish them as authorities in a relevant topical space.

Ideally, each ambassador would have 1-2 spaces to own. For a product like Salesforge, some relevant topics would be:

How to do outreach

Sales (in a more general sense): setting up a strategy and a team, leading, etc.

Technical implementation of outreach: email deliverability, (avoiding) the spam box, etc.

The second piece in the brand play is looking to set up content-based partnerships.

My goal here would be to connect with and expose Salesforge to OPAs – other people’s (established) audiences.

This includes getting on podcasts, co-hosting webinars, writing a newsletter for someone’s Substack or even starting your own YouTube channel.

Lifecycle Marketing & Activation

We’ve covered the main acquisition channels, but we shouldn’t ignore what happens down the funnel. Focusing too much on acquisition without keeping a close eye on activation and conversion is a recipe for disaster – and more than one potential unicorn has found its doom because of it.

(Anyone remember Quibi?)

Let’s take a quick look at the products in the email outreach space:

They are complex: The learning curve is steep; using them requires various skills.

You need to complete multiple steps: Gather an email list, complete a fairly complex technical implementation, create marketing assets (email copy).

Long time-to-value: Between setting up your account, warming up your inbox(es), and closing deals from your outreach campaigns, experiencing the value of these tools can take a while.

Between these factors, just offering a free trial (even for an extended period) does not guarantee success.

So what do you do?

Most tools (Salesforge included) offer a highly customized white glove session when you start a trial. (If anything, this is a testament to the complexity mentioned above.)

This is a good approach, but it has limitations:

Obviously, it doesn’t scale – you want more people using your tool, but you can’t handle too many with this approach. This creates an inherent conflict.

People hate getting on calls and would do anything to avoid them. Especially those who are part of smaller teams and are used to figuring things out on their own.

In the short term, it’s fine to keep the white glove option open to those who want it. Longer term, as you add more new accounts, you’ll want to differentiate in some way between leads with high potential (and offer them a white glove service) and those you want to leave to self-serve completely (to whom you can offer them a pre-recorded demo or similar).

Onboarding sequence

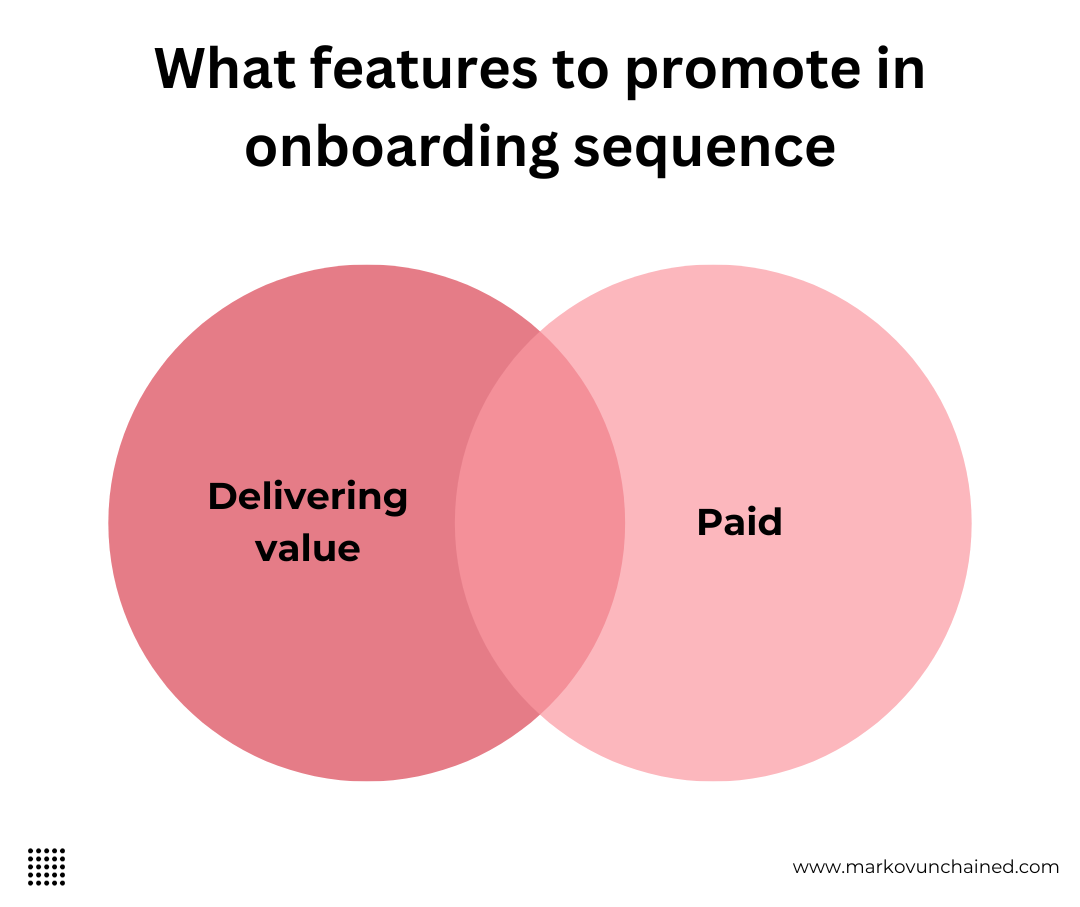

In addition to the approaches discussed above, I would also add an email sequence to educate new users on the features that correspond with experiencing value.

Elena already covered this in detail on her newsletter, so I’m not going to do it in detail, but I just want to add that when Olina implemented a similar onboarding flow for Toggl Track, we saw a significant engagement with both the emails and performing the desired action(s) (i.e. using the features we were pointing them to).

This works best with features that are both:

Delivering value for new users

Part of your premium offering (i.e. paid)

For Toggl, one of these was Billable rates – if you’re ever worked for an agency, you know these are a game-changer because they help you understand when you’re generating revenue vs. doing busywork.

So, we focused on educating new users on why and how to use the billable rates feature within Track as one of the pillars of the onboarding flow.

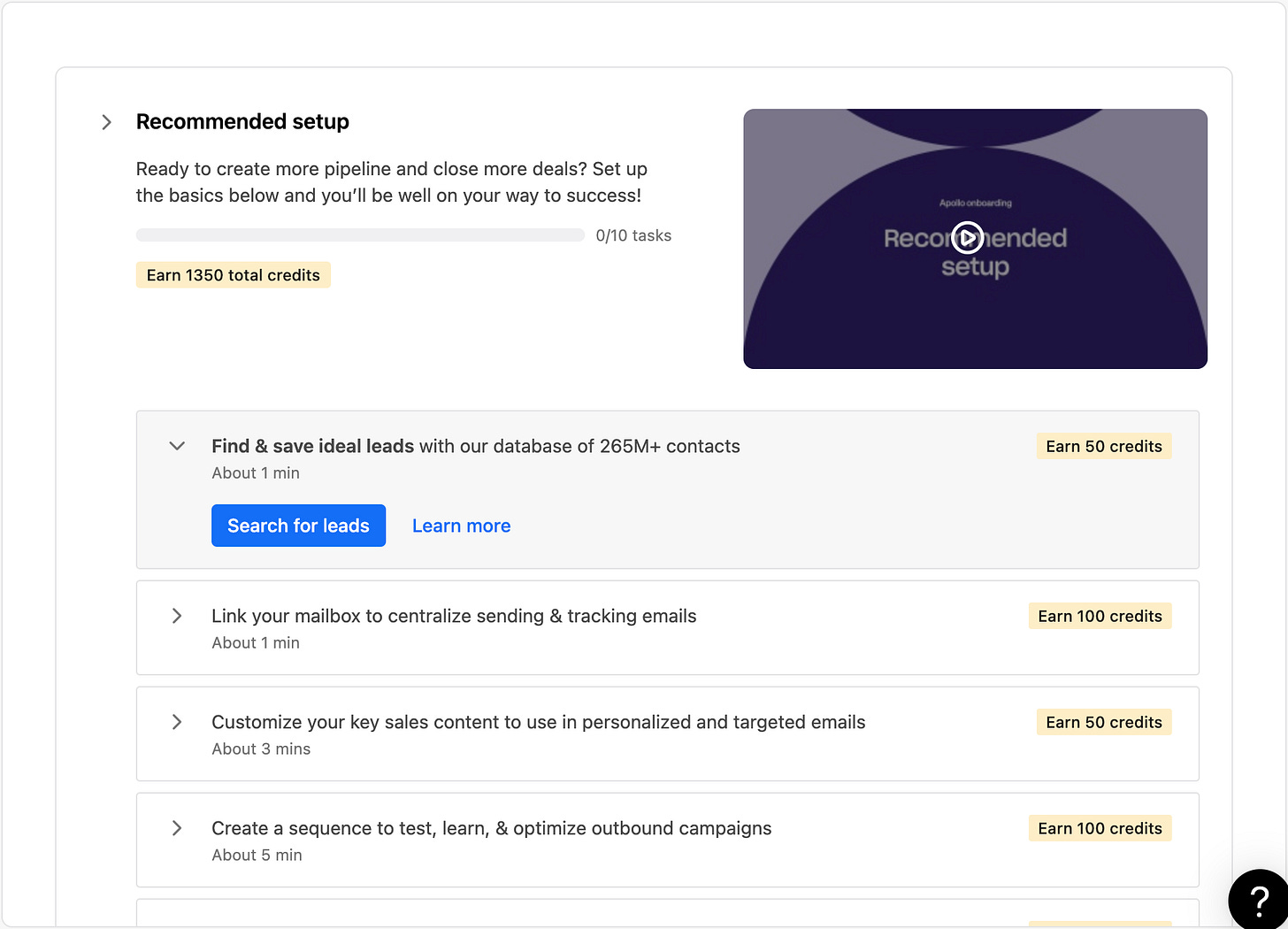

Gamified onboarding

Tools in the category, that rely on PLG, all use a gamified onboarding experience where they give additional usage (credits to send emails, etc.) to users who perform a set of desirable (from the POV of the company) actions.

These include things like connecting your inbox, completing the technical setup, sending out the first campaign, and so on.

Gamification is a great way to create motivation to go through a tedious and complicated process, so it’s no wonder it’s a preferred tactic for many companies in this space.

Measuring success

No growth strategy is complete without a clear framework for how we measure and track success.

But how should we think about the metrics we’re using.

Too many teams fall in a pattern of randomly following a plethora of numbers just for the sake of measuring.

Usually, it’s a mix of everyone tracks this and when we track more numbers, we can always show progress/success somehow.

Unsurprisingly, I don’t believe this is a good approach.

On the other hand, you can’t just use revenue either. Typically, there’s a disconnect between what you’re doing right now and the moment it turns into revenue. You need a framework of metrics that:

serve as a proxy to revenue at each step and

help you understand where you’re performing well and what steps of your framework can be improved

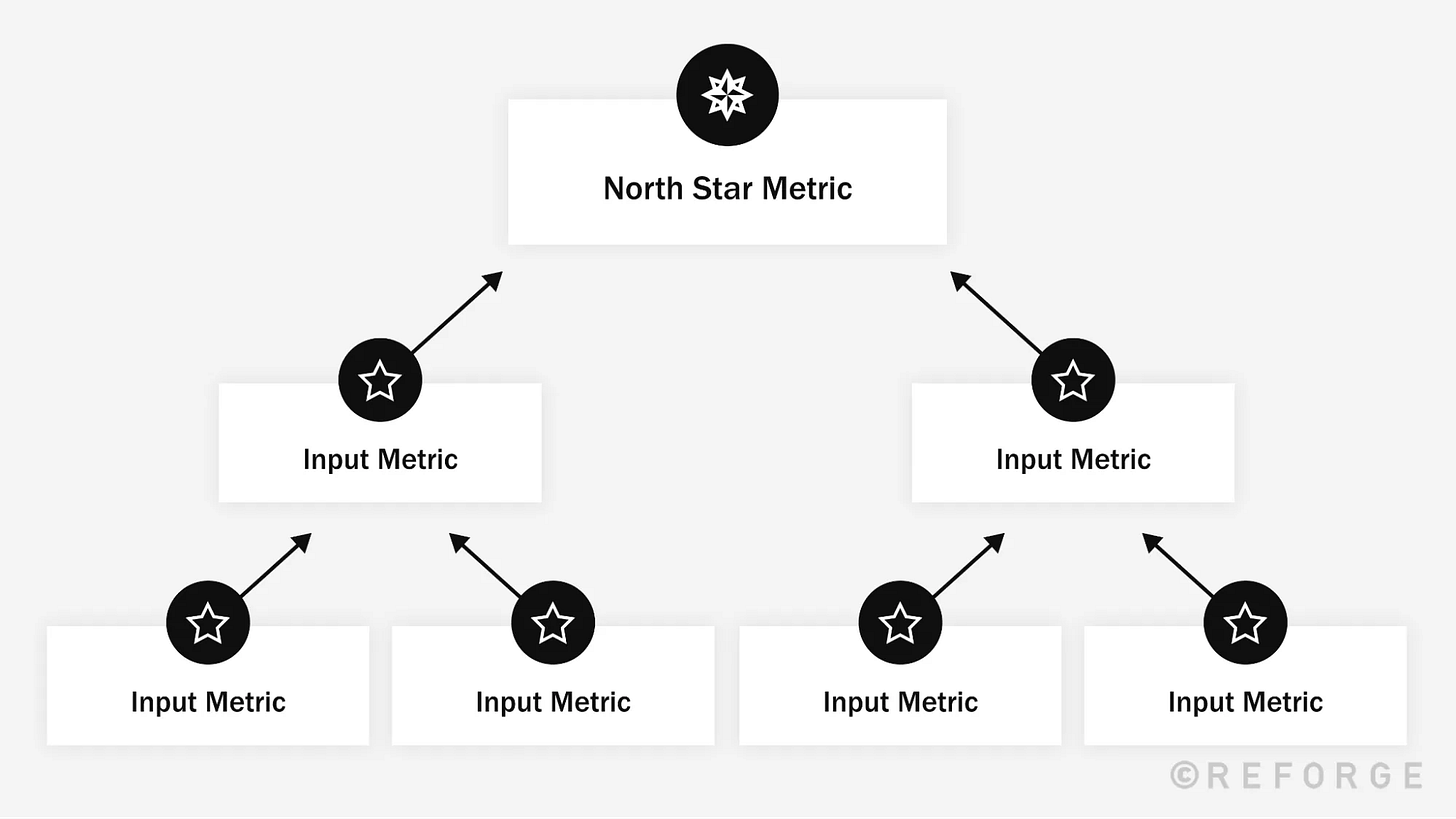

Enter the constellation of metrics:

It is another concept I’ve learned from the Reforge team. Here’s what it would look like for Salesforge:

Content: Create a list of target keywords you’re trying to rank for (repeat every time you go after a new set of KWs):

Track impressions, average position, and clicks for the KWs on the list in Google Search Console (GSC)

Overall organic traffic in Google Analytics (GA)

Trials started from Organic channel (set up event tracking in GA)

Performance:

Paid customers by channel (Google, Meta) and campaign. (Performance channels should drive revenue.)

Brand and Social:

Traffic to your website from Direct channel (in GA). (Over time you’ll be getting a lot of direct traffic from people coming to log in, you can work with an expert to filter it out.)

Branded searches in GSC

Share of voice is an interesting way to understand how powerful your brand is in your area, but I’m yet to see a convincing way to measure it.

Lifecycle & Activation:

Aha moment: share of new users who reach it

Activation rate: Share of new users who become activated (you’d need to define what it means).

Trial-to-paid conversion rate: Usually tracked in whatever product analytics tool you’re using (Heap, etc.)

Still too many metrics? Perhaps.

What matters is not the number of metrics you’re tracking, but how well they represent the performance of your growth model in its different stages. That way, you can a) set up a benchmark for your performance and b) focus on choke-points (i.e. the places where you believe performance should be better or those where it gets worse over time).

Marketing/Growth Measurement deserves its own post, but I’m going to stop here for now.

Outro: What about the growth framework?

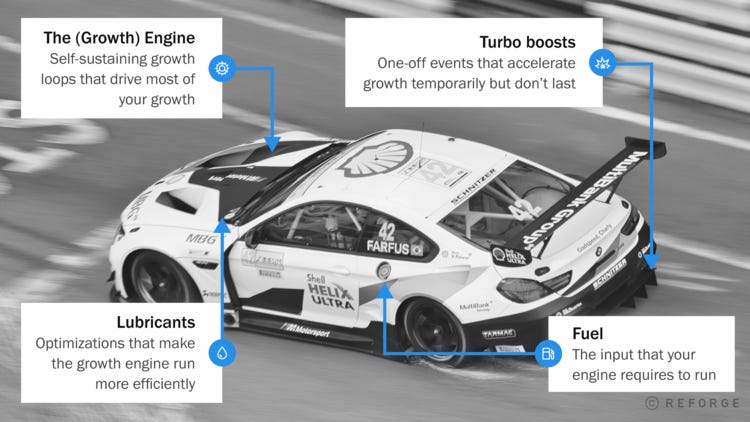

The observant reader will notice that in my last post I introduced lifted Reforge’s Racecar Growth Framework:

I still believe it’s one of the most powerful tools when it comes to thinking about growth systemically (vs. haphazardly).

Let’s examine how the strategy I’m proposing fits into this framework.

As a summary, the elements I proposed above are:

Positioning & Messaging

Content Marketing

Performance Marketing

Brand & Social Selling

Lifecycle & Activation

Here’s how they fit in the Racecar concept:

Positioning and Messaging are strategic pieces – they don’t really fit (or belong) in a growth framework. I’d even argue that these are things you need to figure out for your company as a whole and not just as means to growth/marketing.

Content & Performance Marketing are two separate ⚙️ engines that serve (slightly) different purposes – the performance engine is meant to create and harvest demand (especially in the short term), while content should is meant to establish a stable foundation for generating new trials and customers.

Brand serves as a 💧 lubricant which helps the brand close more deals over time by becoming more recognizable and trusted. Audience partnerships (with podcasts, etc.) are meant to provide short-term 💥 turbo boosts to drive initial attention and ignite the regular growth loops.

Finally, the product efforts around onboarding and activation serve as 💧 lubricants which are meant to ensure the best experience for those who choose to engage with Salesforge.

And when it comes to ⛽ the fuel Salesforge relies on – it’s capital, i.e. revenue, because with every new dollar, the company can re-invest in its 2 engines paid and content.

That’s it!

Loved it? Let me know.

Hated it? Definitely let me know!